Thoughts on Inflation...

We talk alot about global events from the perspective of what this will do to our portfolios. While there is initial shock to the US Stock Market the markets did what they do. They take inventory and repriced the events.

As we discuss often, current events have an impact on the Stock Market, and since most of us are dealing in time horizons measured in decades not months these risks can be absorbed.

What seems to be more important is the impact on our wallets.

For most of generation x & y inflation has been something we’ve read about in old newspapers or history books. That changed this year when inflation went from rumor, to transitory to dominating headlines.

As you have booked flights, hotels, paid for gas, groceries etc you have no doubt noticed major price changes. Ive included a chart below outlining changes in some of these sectors.

The next chart shows the real impact of inflation on wage growth. You may be like many who have gotten a wage increase but don’t feel it. Simple explanation is the price increases in many of the goods and services you purchase have washed out the increase in wages.

Given this data, what are we supposed to do. Here are a couple of thoughts.

1. Take inventory of your current spending. Lifestyle creep is a real thing and when prices are increasing its easy to get behind the 8 ball.

2. If you have known expenses, you may benefit from going ahead and paying for them. For example Kara and I are taking a trip in July and we went ahead and purchased flights and hotels to lock in current prices.

3. Prioritize your spending. Taking actions like automating retirement savings, college savings and savings toward other goals before you spend the discretionary ensures your goals don’t take a back seat.

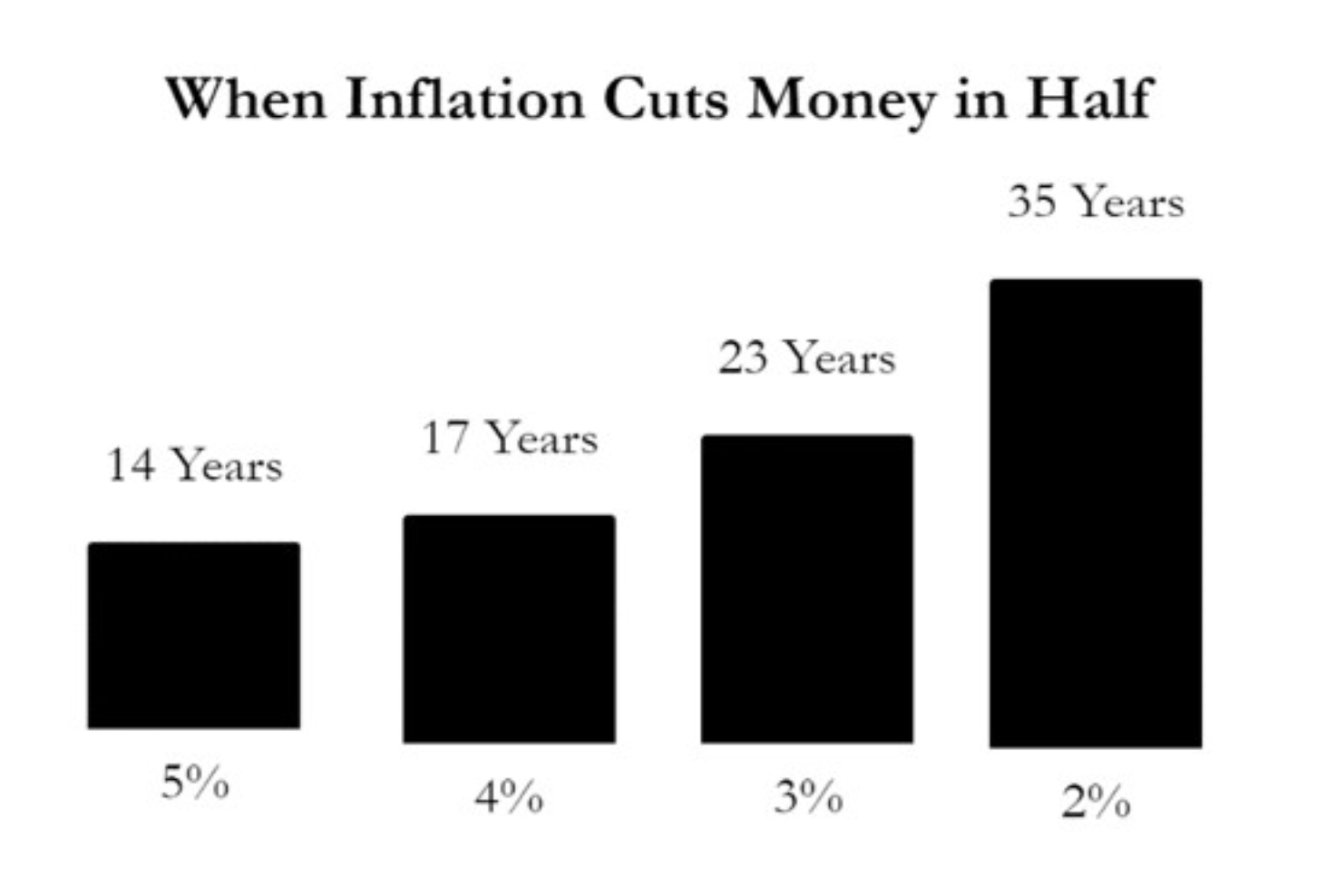

4. Focus on purchasing assets that have potential to grow as time unfolds. The chart below shows the powerful impact inflation has on spending power over time. Purchasing assets who’s growth keeps pace with inflation can offset the impact of inflation. Furthermore, being a conservative investor may feel more safe but as you will see below over time presents a greater risk to your purchasing power.

If you have concerns or questions please do not hesitate to reach out.

Take the Long View!

PK

REF: 4751924