What to do when the Market Corrects...

Every once in a while the Stock Market checks our commitment. The first part of 2022 has done just this.

There are lots of reasons this correction could be happening and the difficult part is we won’t know how deep and long it will go until it has rebounded.

Michael Batnick, Partner, Ritholtz Wealth Management maintains a great chart that shows there is always a reason to sell.

Often when markets correct, our posture tends toward the reactive, waiting to see what they will do to us or our portfolio. I think it’s better to be proactive.

Below are a few proactive steps you can take that may benefit your long term goals.

Take a Deep Breath

If you are investing over decades which we all are, this correction likely won’t have a great impact.

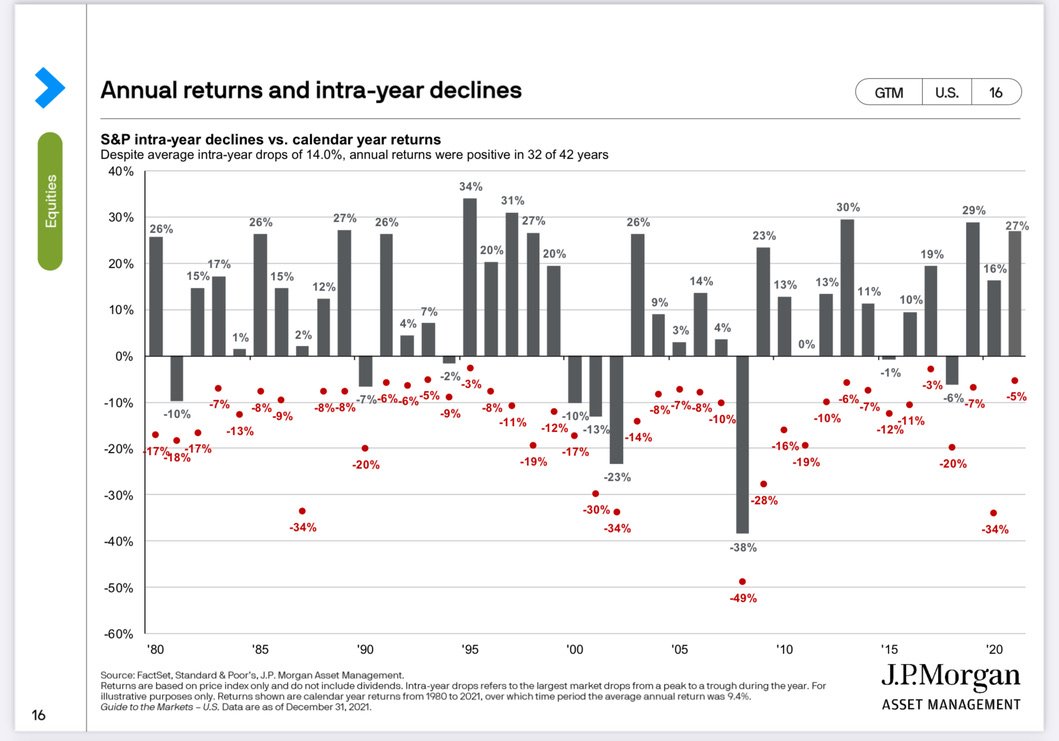

This is completely normal. The chart below shows previous years where the US Stock market has pulled back and how it finished the year .

Check to make sure you have cash for emergencies.

With Surplus cash, frontload or top off annual savings goals.

Make lump sum deposits into 401(k), 529, Traditional IRA, Roth IRA or taxable Brokerage

Look for opportunities to harvest losses in your taxable brokerage account or Employee Stock Plans to pair against future capital gains or write off your current year income.

Rebalance portfolio to make sure risk in line with your objectives.

Make sure your portfolio is properly diversified.

Remember the Stock Market is a collection of companies that thrive and struggle during different market cycles.

Market corrections are a natural part of investing. How we react will determine how successful we will be in reaching our goals.

If you have concerns or questions please do not hesitate to reach out.

Take the Long View!

PK

REF: 4359736